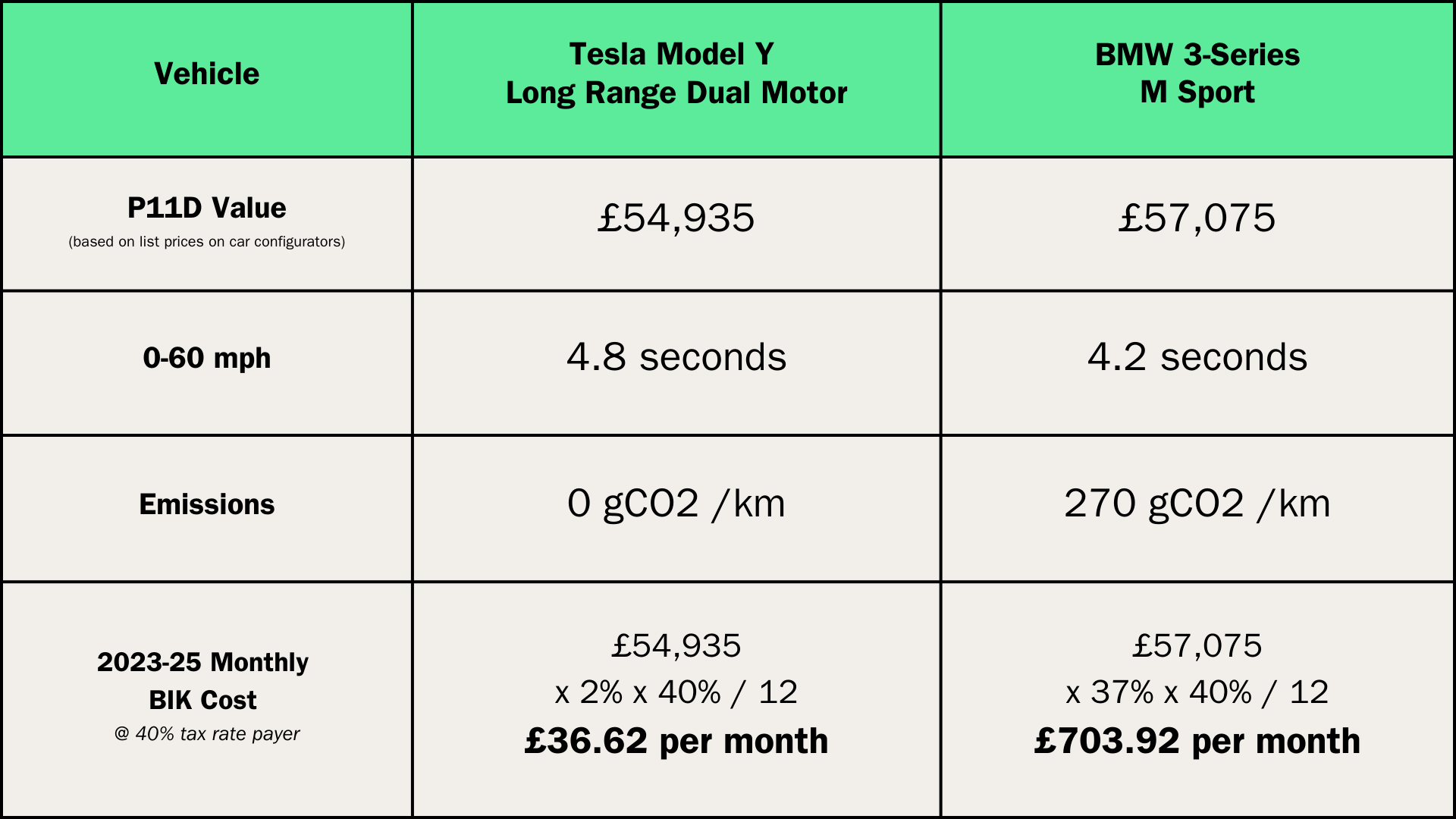

Electric Car Benefit In Kind 2024/25. There are many benefits of switching your company car fleet to electric. The vehicle is fully electric;

There are many benefits of switching your company car fleet to electric. For 2023 and 2024, a reduction of €10,000 can be applied to the omv of cars in categories a, b, c and d.

Electric Car Benefit In Kind 2024/25 Dayle Daniela, Therefore, its emissions are 0g/km co 2 and has a list.

Electric Car Benefit In Kind 2024/25 Dorie Geralda, Company car tax, aka benefit in kind (bik) rate, for all zero emmision cars is set by the government.

Benefit In Kind On Electric Cars 2024/25 Kiah Selene, In recent years, electric vehicles (evs) and hybrid cars have benefited from lucrative bik rates.

Benefit In Kind On Electric Cars 2024/25 Trude Hortense, For all fully electric cars on sale, the bik rate is just 2% during the 2022/23 tax year at which it will remain during 2023/24 and 2024/25 (see table below).

Benefit In Kind On Electric Cars 2024/25 Trude Hortense, Benefit in kind is increasing for all cars from 2025, apart from those with the highest emissions, because they’re already paying the top level bik rate.

Electric Car Benefit In Kind 2024/25 Dorie Geralda, The reduction is not applicable to cars in category e.

Electric Car Benefit in Kind (BiK) Salary Sacrifice Guide — The, Aug 29, 2024 • 8 min read

The Ultimate Guide to Electric Car Benefit in Kind We Power Your Car, Company car tax, aka benefit in kind (bik) rate, for all zero emmision cars is set by the government.

Benefit In Kind On Electric Cars 2024/24 Shaun Katinka, The complete guide to benefit in kind, sometimes referred to as electric company car tax, covering what a company and employee need to contribute and how it is calculated.

Electric Car Benefit In Kind 2024/24 Abby Linnea, For 2023 and 2024, a reduction of €10,000 can be applied to the omv of cars in categories a, b, c and d.